If you want to invest in mutual fund you will be open free mutual fund account in mutual fund status website.

If you want to invest in mutual fund you will be open free mutual fund account in mutual fund status website.

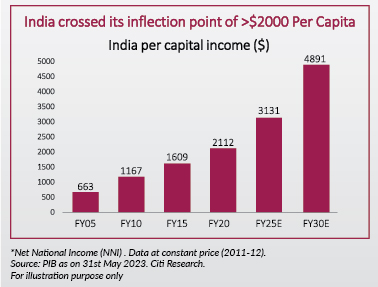

When a country hits an inflection point, it experiences major infrastructure growth, increased consumption, and strong economic expansion. For India, this moment is seen in the rise of wealthy households, leading to more spending on luxury items. As incomes rise, people can easily meet their basic needs and spend more on their wants.

| Mutual Fund | Axis Mutual Fund |

| Scheme Name | Axis Consumption Fund |

| Objective of Scheme | To provide long term capital appreciation from an actively managed portfolio of equity and equity related securities of companies engaged in consumption and consumption related sector or allied sectors. There is no assurance that the investment objective of the Scheme will be achieved |

| Scheme Type | Open Ended |

| Scheme Category | Equity Scheme - Sectoral/ Thematic |

| New Fund Launch Date | 23-Aug-2024 |

| New Fund Earliest Closure Date | 06-Sep-2024 |

| New Fund Offer Closure Date | 06-Sep-2024 |

| Indicate Load Seperately | Entry Load: Not Applicable Exit Load: If redeemed / switched-out within 12 months from the date of allotment: For 10% of investments: NIL For remaining investments: 1% If redeemed / switched-out after 12 months from the date of allotment: NIL |

| Minimum Subscription Amount | Rs. 100 and in multiples of Re. 1/- thereafter |

| For Further Details Please Visit Website | https://www.axismf.com |

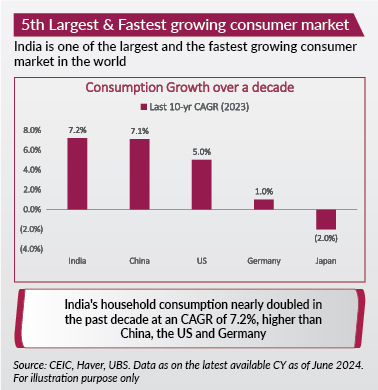

India's household consumption nearly doubled in the past decade at a CAGR of 7.2%, higher than China, the US, and Germany.

India's economic landscape is rapidly evolving, fueled by a growing population and the emergence of the world's largest middle class. This demographic shift, coupled with increasing income levels and aspirations, is driving a significant uptick in consumption. Such a trend offers a golden opportunity for businesses to capitalize on the expanding market, making it an ideal time to invest in India's consumption-driven growth story.

With these impressive statistics, it’s clear that India’s consumption of consumer goods is skyrocketing, driving robust growth across various sectors. You can also be a part of this consumption growth by investing in Axis Consumption Fund, with a minimum investment starting from only ₹100.

| Mutual Fund | Aditya Birla Sun Life Mutual Fund |

| Scheme Name | Aditya Birla Sun Life Nifty India Defence Index Fund |

| Objective of Scheme | The investment objective of the Scheme is to provide returns that, before expenses, correspond to the total returns of securities as represented by the Nifty India Defence Total Return Index, subject to tracking errors. |

| Scheme Type | Open Ended |

| Scheme Category | Other Scheme - Index Funds |

| New Fund Launch Date | 09-Aug-2024 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 23-Aug-2024 |

| Indicate Load Seperately | |

| Minimum Subscription Amount | 500 |

| For Further Details Please Visit Website | https://mutualfund.adityabirlacapital.com/ |

As of August 2024, several mutual funds are standing out due to their strong performance and investment potential:

Fidelity Blue Chip Growth Fund (FBGRX): This fund focuses on large-cap growth stocks, particularly in the technology sector, with top holdings including Nvidia, Apple, and Microsoft. It has a low expense ratio of 0.48% and has significantly outperformed the S&P 500 over the past decade.

Vanguard 500 Index Fund Admiral Shares (VFIAX): This is a well-known index fund that tracks the S&P 500, offering broad exposure to the U.S. stock market. It’s a solid choice for investors seeking steady, long-term growth with minimal fees.

Fidelity Small Cap Index Fund (FSSNX): This fund targets small-cap stocks, which can offer higher growth potential over time. Although small caps have been under pressure due to high interest rates, this fund has recently started to perform well as the market rotates back into small-cap stocks.

Fidelity Select Healthcare Portfolio (FSPHX): Known for its focus on the healthcare sector, this fund has been consistently strong, particularly in a market environment where healthcare innovation continues to drive growth.

Dodge & Cox Stock Fund (DODGX): This fund is managed with a value-oriented approach, investing in large-cap U.S. companies. It’s known for its disciplined strategy and long-term performance.

T. Rowe Price Global Technology Fund (PRGTX): For those interested in global tech exposure, this fund provides a diversified portfolio of technology companies from around the world.

Vanguard Total Stock Market Index Fund (VTSAX): This fund gives investors access to the entire U.S. stock market, including small, mid, and large-cap growth and value stocks. It's a low-cost option with broad diversification.

A mutual fund is a type of investment vehicle that pools money from multiple investors to purchase a diversified portfolio of securities, such as stocks, bonds, or other assets. The fund is managed by professional portfolio managers who aim to achieve specific investment objectives, such as growth, income, or a balanced mix of both.

Diversification: By pooling money, mutual funds can invest in a wide range of securities, reducing the risk of significant losses if one particular investment performs poorly.

Professional Management: Experienced fund managers make investment decisions based on research and analysis, allowing investors to benefit from their expertise.

Liquidity: Mutual funds are generally easy to buy and sell, with shares being redeemable at the fund's current Net Asset Value (NAV) at the end of each trading day.

Variety: There are many types of mutual funds, including equity funds, bond funds, money market funds, index funds, and sector funds, each with different investment goals and strategies.

Costs and Fees: Mutual funds charge fees for management and other expenses. These can include the expense ratio (an annual fee), front-end or back-end loads (sales charges), and other administrative fees.

Regulation: Mutual funds are regulated by government agencies, such as the Securities and Exchange Commission (SEC) in the United States, ensuring a level of transparency and protection for investors.

Equity Funds: Invest primarily in stocks, aiming for growth over time.

Bond Funds: Focus on bonds or other fixed-income securities, often seeking income generation and stability.

Money Market Funds: Invest in short-term, low-risk securities, offering liquidity and safety, with lower returns.

Balanced Funds: Combine stocks and bonds to provide a mix of growth and income.

Index Funds: Track a specific index, such as the S&P 500, aiming to replicate its performance.

Sector Funds: Focus on specific sectors of the economy, like technology or healthcare.

| Mutual Fund | Aditya Birla Sun Life Mutual Fund |

| Scheme Name | Aditya Birla Sun Life Nifty India Defence Index Fund |

| Objective of Scheme | The investment objective of the Scheme is to provide returns that, before expenses, correspond to the total returns of securities as represented by the Nifty India Defence Total Return Index, subject to tracking errors. |

| Scheme Type | Open Ended |

| Scheme Category | Other Scheme - Index Funds |

| New Fund Launch Date | 09-Aug-2024 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 23-Aug-2024 |

| Indicate Load Seperately | |

| Minimum Subscription Amount | 500 |

| For Further Details Please Visit Website | https://mutualfund.adityabirlacapital.com https://mfassetscloud.fundexpert.net/ |

| Mutual Fund | Bandhan Mutual Fund |

| Scheme Name | BANDHAN NIFTY BANK INDEX FUND |

| Objective of Scheme | The investment objective of the Scheme is to replicate the Nifty Bank Index by investing in securities of the Nifty Bank Index in the same proportion / weightage with an aim to provide returns before expenses that track the total return of Nifty Bank Index, subject to tracking errors. However, there is no assurance or guarantee that the objectives of the scheme will be realized and the scheme does not assure or guarantee any returns. |

| Scheme Type | Open Ended |

| Scheme Category | Other Scheme - Index Funds |

| New Fund Launch Date | 08-Aug-2024 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 22-Aug-2024 |

| Indicate Load Seperately | 0.25% - if redeemed on or before 15 days from the allotment date. Nil – if redeemed after 15 days from the allotment date. |

| Minimum Subscription Amount | Rs. 1000/- and any amount thereafter |

| For Further Details Please Visit Website | https://www.bandhanmutual.com https://mfassetscloud.fundexpert.net/ |

| Mutual Fund | HDFC Mutual Fund |

| Scheme Name | HDFC NIFTY500 Multicap 50:25:25 Index Fund |

| Objective of Scheme | To generate returns that are commensurate (before fees and expenses) with the performance of the Nifty500 Multicap 50:25:25 Index, subject to tracking error. There is no assurance that the investment objective of the Scheme will be achieved. |

| Scheme Type | Open Ended |

| Scheme Category | Other Scheme - Index Funds |

| New Fund Launch Date | 06-Aug-2024 |

| New Fund Earliest Closure Date | 20-Aug-2024 |

| New Fund Offer Closure Date | 20-Aug-2024 |

| Indicate Load Seperately | ENTRY LOAD : NA EXIT LOAD : NA |

| Minimum Subscription Amount | 100 |

| For Further Details Please Visit Website | https://www.hdfcfund.com https://mfassetscloud.fundexpert.net/ |

| Mutual Fund | Motilal Oswal Mutual Fund |

| Scheme Name | Motilal Oswal Business Cycle Fund |

| Objective of Scheme | To achieve long term capital appreciation by predominantly investing in equity and equity related instruments of companies by investing with a focus on riding business cycles through allocation between sectors and stocks at different stages of business cycles. However, there can be no assurance that the investment objective of the scheme will be realized. |

| Scheme Type | Open Ended |

| Scheme Category | Equity Scheme - Sectoral/ Thematic |

| New Fund Launch Date | 07-Aug-2024 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 21-Aug-2024 |

| Indicate Load Seperately | 1% - If redeemed on or before 3 Months from the date of allotment. Nil - If redeemed after 3 Months from the date of allotment. |

| Minimum Subscription Amount | Rs. 500/- and in multiples of Re.1/- thereafter |

| For Further Details Please Visit Website | https://www.motilaloswalmf.com https://mfassetscloud.fundexpert.net/ |

| Mutual Fund | Mirae Asset Mutual Fund |

| Scheme Name | Mirae Asset Nifty500 Multicap 50:25:25 ETF |

| Objective of Scheme | The investment objective of the scheme is to generate returns, before expenses, that are commensurate with the performance of the Nifty500 Multicap 50:25:25 Total Return Index, subject to tracking error. The Scheme does not guarantee or assure any returns. There is no assurance that the investment objective of the scheme will be achieved. |

| Scheme Type | Open Ended |

| Scheme Category | Other Scheme - Other ETFs |

| New Fund Launch Date | 12-Aug-2024 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 26-Aug-2024 |

| Indicate Load Seperately | NIL |

| Minimum Subscription Amount | Rs. 5,000 and in multiples of Re. 1/- thereafter. |

| For Further Details Please Visit Website | https://www.miraeassetmf.co.in https://mfassetscloud.fundexpert.net/ |

| Mutual Fund | Bank of India Mutual Fund |

| Scheme Name | Bank of India Business Cycle Fund |

| Objective of Scheme | The Investment objective of the Scheme is to generate long-term capital appreciation by investing predominantly in equity and equity related securities through dynamic allocation between various sectors and stocks at different stages of business cycles in the economy. However, there is no assurance that the investment objective of the Scheme will be achieved. |

| Scheme Type | Open Ended |

| Scheme Category | Equity Scheme - Sectoral/ Thematic |

| New Fund Launch Date | 09-Aug-2024 |

| New Fund Earliest Closure Date | 23-Aug-2024 |

| New Fund Offer Closure Date | 23-Aug-2024 |

| Indicate Load Seperately | |

| Minimum Subscription Amount | 5000 |

| For Further Details Please Visit Website | https://www.boimf.in https://mfassetscloud.fundexpert.net/ |